It is encouraging to witness the spirit of African innovation colliding with the conundrum of financial inclusion for enhanced long-term African savings. Africa’s youth has proven to be a critical factor in transforming the medium and channels of savings through accelerated technology adoption. Pension savings on the continent are growing, but this growth can be accelerated through paradigm shifts around pension policy, regulation, incentives and mediums to enable greater participation rates.

- Sources 2022:

World Social Protection Report 2022 – 2022, International Labour Organization - Social Protection for the Informal Economy, The World Bank

- The Mobile Economy, Sub-Sharan Africa 2021, GSM Association

- Central Bank of Kenya Annual Report, 2021

- African Union, The Digital Transformation Strategy for Africa (2020 – 2030)

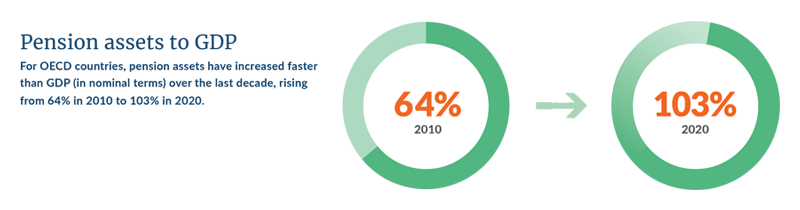

- OECD Pensions at a Glance, 2021

- https://population.un.org/dataportal/data/indicators/67/locations/910,911,912,913,914,903/start/2020/end/2050/table/pivotbylocation

- Partech Partners’ Africa Tech Venture Capital Report (2020)

- thebigdeal.substack.com

- Nyang’oro, Owen, and Githinji Njenga. Pension Funds In Sub-Saharan Africa, WIDER Working Paper 2022/95 Helsinki: UNU-WIDER, 2022

Africa’s pension industry

The latest Bright Africa Pensions research highlights the measures required to improve future pension coverage for economically active Africans.

learn moreForeword

Where pensions systems exist across most of Africa, they do so against a backdrop of elevated levels of informality in labour markets. The result is that the pension contributions outside of the public sector are intermittent and relatively low.

learn morePension funds and social security

The standard narrative across the continent is of a small percentage of the population in formal employment for whom social security is possible.

learn moreEarly adopters of technology

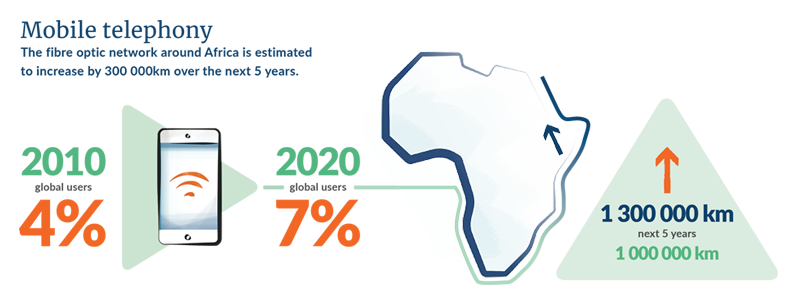

Africa can leverage its high mobile telephony penetration and digital adoption to tackle a foundational challenge to improved provision of social protection: enrollment.

learn moreAfrica’s pension fund assets

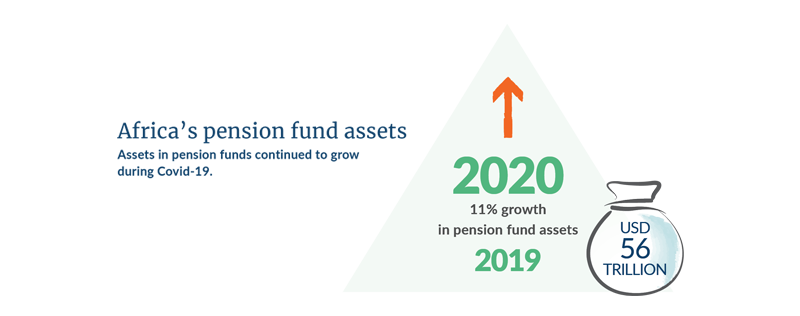

According to the Organisation for Economic Co-operation and Development (OECD), assets in pension funds continued to grow throughout 2020, growing by 11% from the end of 2019 to a reported USD56 trillion as of the end of 2020.

learn moreConclusion

Pension savings on the continent are growing, but this growth can be accelerated through paradigm shifts around pension policy, regulation, incentives and mediums to enable greater participation rates.

learn more